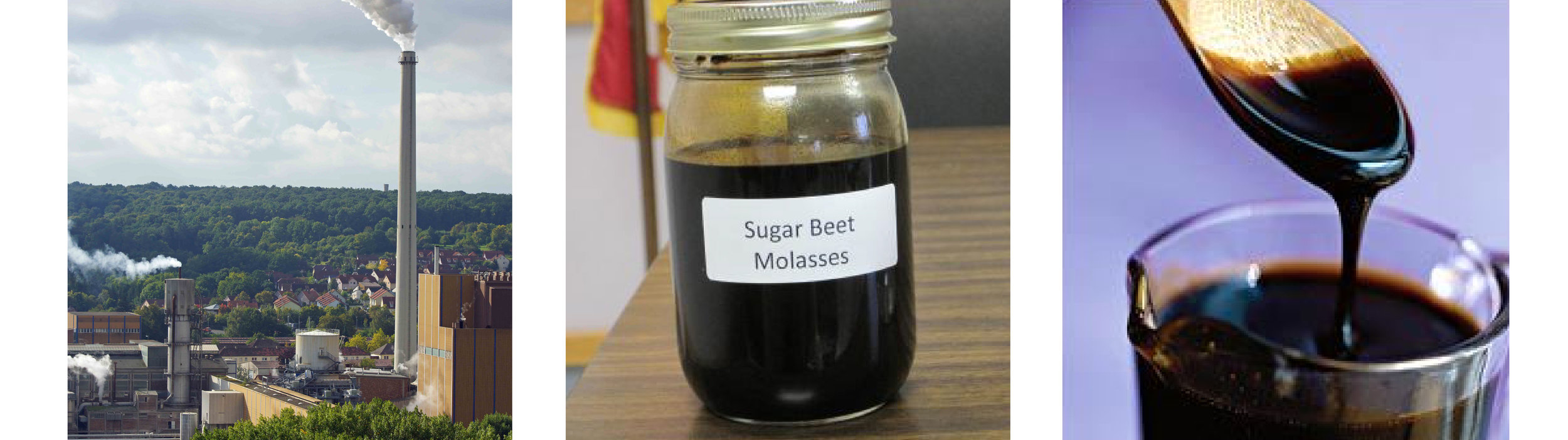

WHAT IS MOLASSES?

Molasses is a thick, sweet syrup, inevitably resulting from beet or cane sugar production. Molasses contains unextractable sugar, vitamins and minerals, such as calcium, sodium, potassium and magnesium. Molasses is an inevitable final material arising from sugar production.

HOW IS MOLASSES USED?

Beet molasses produced in the EU is mainly (70%) used for the production of ethanol (source: CEFS). Molasses is also used by the yeast and fermentation industries for the production of yeast, citric acid, vitamins, amino acids and lactic acid, as well as by the animal feed industry.

Molasses represents only 22% of the agricultural feedstocks used by the European fermentation industry (source: CEFIC). In fact, the fermentation industry prefers using sugar and sugar thick juices formed during the production of sugar (29% of feedstocks) to using molasses (Source: EFG). The other feedstocks for the European fermentation industry are starch and glucose based (49%).

As a feed additive, molasses represents a small market in the animal feed sector (in most cases representing a small part of the feed ration). In any case, the EU animal feed industry uses mainly imported sugar cane molasses because of its better palatability compared to beet molasses.

In third countries, cane molasses is increasingly used as the main feedstock for the production of biofuels, because of its availability and its contribution to the sustainability of the cane sugar industry.

WHERE IS MOLASSES SOURCED?

Beet molasses is mainly sourced in the EU while cane molasses is sourced in third countries producing cane sugar. Cheap cane molasses (from ACP and LDC countries and countries benefiting from the GSP agreement and from bilateral agreements) can be imported duty free and quota free in the EU. The main exporters of molasses to the EU are India, Guatemala, El Salvador, Nicaragua and Pakistan.

Imports of molasses are mainly due to the price of cane molasses rather than to a lack of beet molasses. However, imports of molasses to the EU (95% of which is cane molasses) have decreased significantly during the past decade, from 1.8 Mt in 2007 to 1 Mt in 2016 (Source: Eurostat).

EU imports of beet molasses (around 65 000 t annually between 2010 and 2016) are much lower than the imports of cane molasses and are in fact more or less equivalent to EU exports of beet molasses (around 55 000 t annually between 2010 and 2016) (source: Eurostat). This shows that there is absolutely no tension on the EU beet molasses market.

HOW WILL THE AVAILABILITY OF MOLASSES EVOLVE?

With the end of sugar quotas, EU sugar production is expected to increase significantly as from 2017/18 (by around 20% compared to 2016/17). The availability of beet molasses will therefore increase at least in the same proportion. Beet molasses represents a resource that has considerable potential for growth. The capacity of the beet sugar industry to find outlets for its molasses will be a key factor for the competitiveness of the sector. Given this situation and outlook, the supply for the fermentation and feed industry is certainly not at stake.

OPPORTUNISTIC STRATEGIES FROM USERS AT A KEY MOMENT FOR EUROPEAN FARMERS

In addition to the decreasing import trend, as the production of beet molasses has been fairly stable in the EU (quota regime), it can be concluded that the use of molasses (beet and cane) by the yeast, fermentation and animal feed industries has not increased in the EU during this past decade and did not encounter any supply issue while molasses were also used for ethanol production. Why should sugar producers be deprived from such an important market?

For several decades, the fermentation and chemical industries have cried wolf on a theoretical shortage of sugar based and molasses feedstocks which has never materialized. Their strategy was and remains to get access to cheaper raw materials.

No significant growth is expected for the use of molasses in the yeast, fermentation and animal feed industries in the EU. Excluding beet molasses from its main outlet (i.e. biofuels, bioenergy and bio-based products) would put the EU beet sugar industry at risk.

MOLASSES, THE RENEWABLE ENERGY DIRECTIVE PROPOSAL, THE CIRCULAR ECONOMY AND THE BIOECONOMY

The uses of molasses reflect its importance in the implementation and promotion of the circular economy and of the bioeconomy. Molasses cannot be considered to be a food or a feed crop. The quantity of molasses (non-extractable sugars) is legally defined and well known. Molasses is consequently a ‘processing inevitable material of sugar production. Under no circumstances can molasses ethanol be regarded as a first generation ethanol since molasses is neither a plant nor the primary aim of the sugar production process.

According to the Commissioner Arias Cañete: “only molasses for which the best industry standards for the extraction of sugar have been respected would be eligible so as to produce biofuels. Therefore, the inclusion of biofuels produced from molasses as an eligible fuel under the incorporation obligation set out in Article 25 of the proposal of the recast of the Renewable Energy Directive will not lead to a disadvantage for the fermentation industries. Molasses have been included in Annex IX part B as biofuels produced from molasses can be expected to achieve very high greenhouse gas emission savings. In this context, it should also be noted that the total contribution of biofuels produced from feedstock listed in Annex IX part B to the proposed obligation is limited to 1.7% of transport energy consumption, which would make a surge in demand unlikely” (Commission written answer to the EP E-004177/2017) and certainly not equivalent to the expected surge in production (20%).

According to the European Social and Economic Committee Report “Fostering alternative outlets for sugar beet – such as bioethanol, animal feed, bioplastics, and bio-based chemicals – will be essential for the sector's future competitiveness. The European Commission should maintain the 7 per cent cap on biofuels that can be counted towards the 10 per cent target for renewable energy in transport. Annex IX to the Renewable Energy Directive (2009/28/EC), which classifies molasses as an advanced biofuel feedstock, should remain unchanged”(CCMI/151-EESC-2017).

No discrimination in uses should be introduced. If the EU sugar industry cannot valorize and add value to all its current and new product streams according to market signals, the circular economy and bioeconomy will not function. This means sugar production in the EU will be at stake. If sugar production in the EU were to significantly decrease or disappear, molasses production in the EU would share the same fate.